34+ Principal plus interest calculator

Before you make principal-only payments check that there is no penalty for. Working with an adviser may come with potential downsides such as payment of fees which will reduce returns.

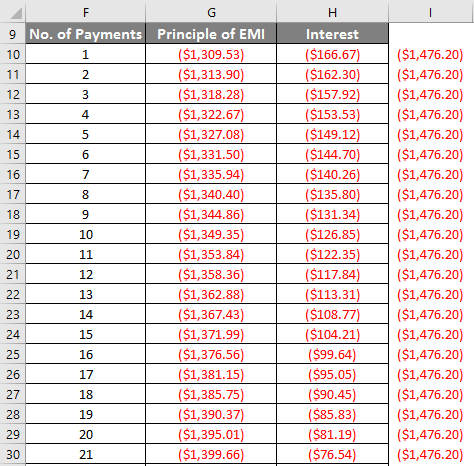

Loan Amortization Calculation Emi Principal And Interest Components Homeloan Via Interest Calculator Mortgage Amortization Calculator Mortgage Payoff

The additional amount you will pay each month over the required Monthly Payment amount to pay down the principal on your loan.

. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. As long as you are making your full mortgage payment principal plus interest each month you should be able to indicate that any extra payments go to the principal. Stamp Duty - Principal Place of Residence PPR Rate For the purchase of a home which will be used as Principal place of residence for contracts entered into on or after 6 May 2008.

A loans interest rate is the cost you pay each year to borrow money expressed as a percentage. Many other variables can influence your monthly mortgage payment including the length of your loan your local property tax rate and whether you have to pay private mortgage insurance. Monthly Principal Interest.

Remaining P I payments. Loan Balance 15 Years. The monthly payment and interest are calculated as if the mortgage or loan were being paid over this length.

Get a 70 star NatHERS rating or higher for up to 159 discount on your variable rate home loan T. The interest rate does not include fees charged for the loan. 2870 plus 6 per cent of the dutiable value in excess of 130000.

This is equal to the median property tax paid as a percentage of the median home value in your county. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.

Mortgage principal and interest taxes secondary financing heating and. Total of 180 Payments. Three repayment options are available - Immediate repayment of principal and interest interest-only payments while in.

In general investing for one period at an interest rate r will grow to 1 r per dollar. Interest Rate APR 31. All investing involves risk including loss of principal.

In our calculator we take your home value and multiply that by your countys effective property tax rate. Some limitations and exclusions may apply. Loan Balance 5 Years.

Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment. This 110 is equal to the original principal of 100 plus 10 in interest. The Calculator assumes interest is compounded semi-annually not in advance.

Loan amount RMB 1080000 Number of payments 216. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Loan Balance 10 Years.

Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Monthly Principal Interest Payment on a 10000 loan.

An additional 50 or even 25 extra principal each month may make a surprising difference. My goal was to use the Loan Calculator with options in order to use the Extra payments feature but before doing so I wanted to make sure that this calculator would give the same results as the Fixed Principal Payment Calculator which was not the case. This is not an offer to buy or sell any.

Equity Built 15 Years. Interest Paid 15 Years. 90Low rate home loan with added benefits add offset for 010.

Scotia Mortgage Protection is an optional insurance coverage. Again Ill paraphrase from the CPFB. Before refinancing a mortgage lenders want to know you can.

Interest can add tens of thousands of dollars to the total cost you repay and in the early years of your loan the majority of your payment will be interest. There are no guarantees that working with an adviser will yield positive returns. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

Estimate the cost of your student payment using our customizing payments tool. The information provided by the calculator is intended to provide illustrative. Assuming you have a 20 down payment 60000 your total mortgage on a 300000 home would be 240000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1078 monthly payment.

The answer is 110 FV. See how your monthly payment changes by making updates to. You can save a lot of interest if you pay down the loan earlyThis extra payment calculator is designed to tell you how much interest and time youll save if you know how much extra you can pay each month.

The annual percentage rate is the cost you pay each year to borrow money including fees expressed as a percentageTherefore the APR is basically the rate-of-return earned by. The calculations assume all payments are made when due. 110 is the future value of 100 invested for one year at 10 meaning that 100 today is worth 110 in one year given that the interest rate is 10.

A P1 rn n t Where A is the future value of the investmentloan including interest P is the principal amount r is the annual rate of interest n is the number of times that interest is compounded per unit t and t is the time the money is invested number of years The above formula gives the total amount. Low Rate Home Loan - Prime Principal and Interest Owner Occupied LVR. Plus your lender may be willing to negotiate an interest rate reduction larger than the standard 025 per point.

Also choose whether Length of Amortized Interest is years or months. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. To find the compound interest use Compound interest A P.

Save thousands.

1

1

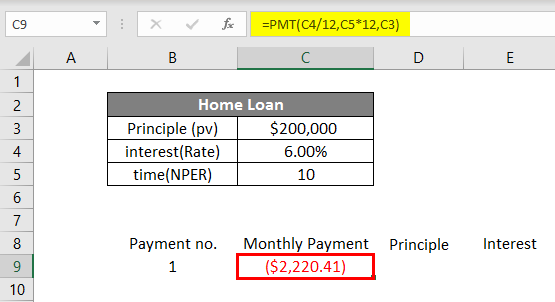

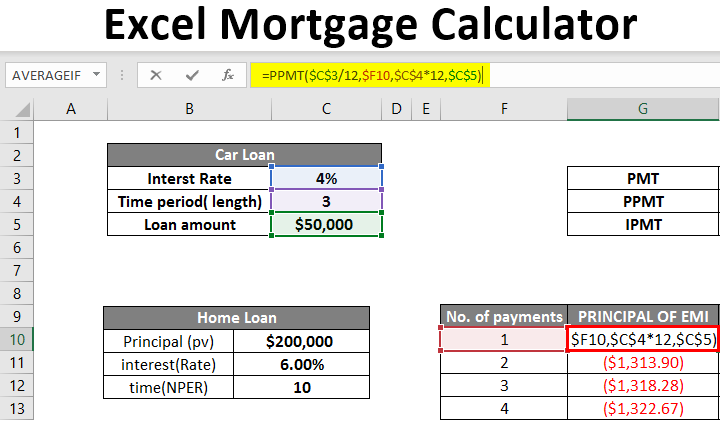

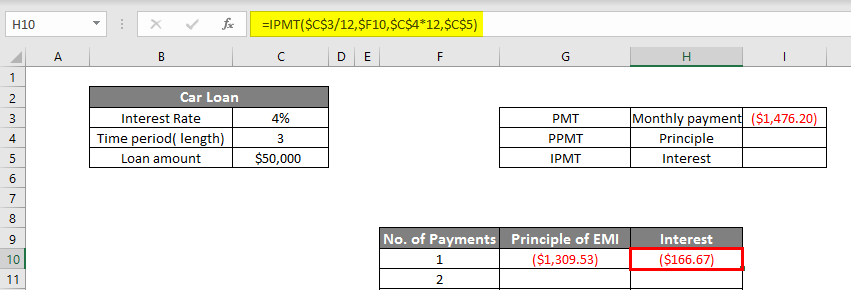

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

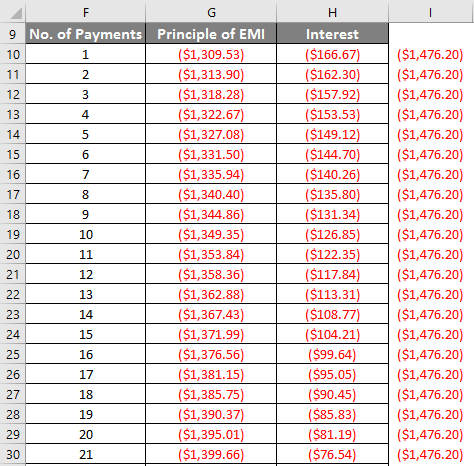

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Car Loan Calculator

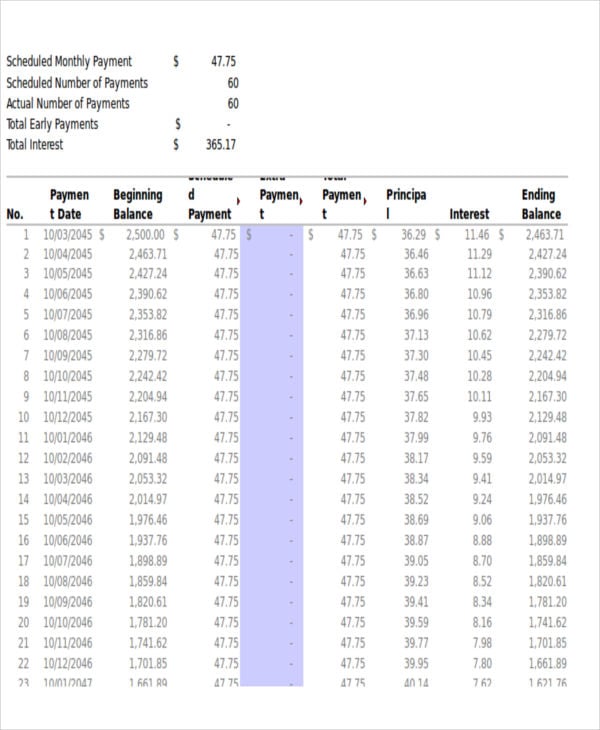

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

1

Amortization Schedule Template 8 Free Word Excel Documents Download Free Premium Templates

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Calculator With Escrow Excel Spreadsheet Mortgage Payment Calculator Mortgage Payment Mortgage

1

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

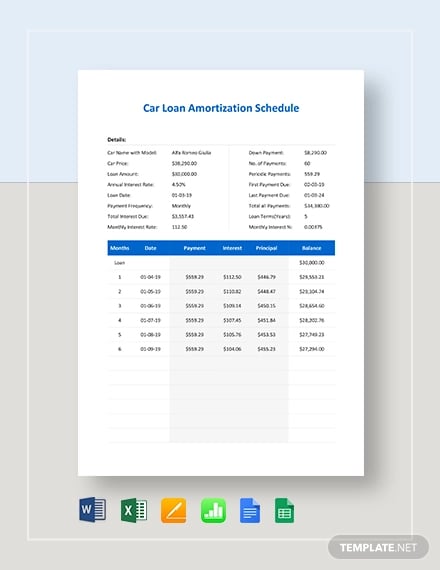

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates